Investment Process

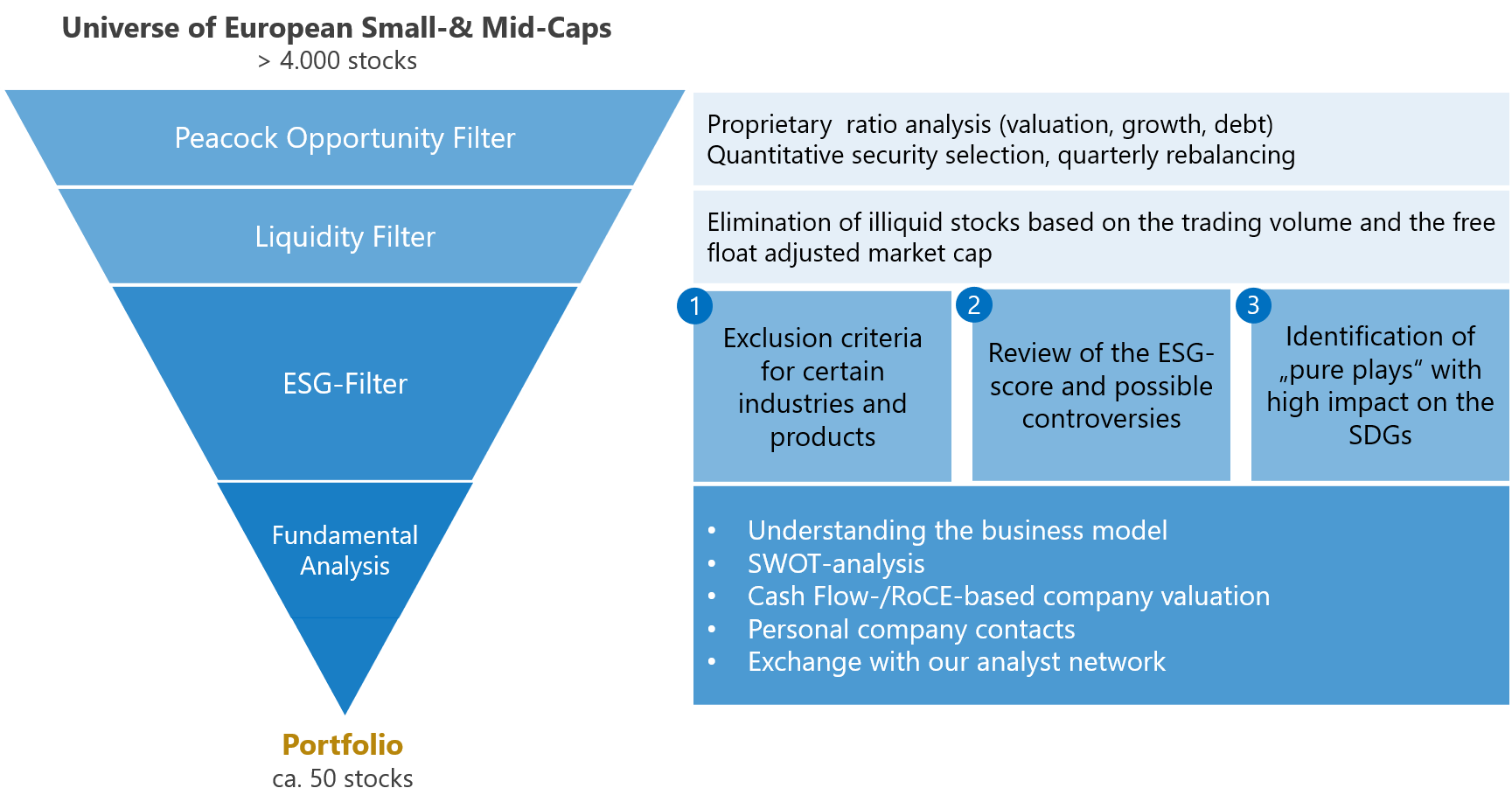

Based on a European equity universe of around 4,000 stocks, we use a 4-step investment process. Based on balance sheet ratios, liquidity parameters, ESG criteria and a fundamental securities analysis, a large number of small & mid cap stocks are filtered out. The end result is a portfolio of approximately 50 stocks with special unique selling points ("Best of Ideas").

According to our experience, a quantitative, ratio-based filter is best suited to separate the universe into strongly undervalued or strongly overvalued securities. Especially when an investment universe is very large and inhomogeneous. This is especially true for European Small Caps whose business models are very diverse. The originally very large universe of more than 4,000 stocks is thus reduced to a manageable size. Our proven Peacock Opportunity Filter is both a source of ideas and a well-proven quantitative filter. Over a period of 20 years certain key figures have emerged as particularly effective for the successful selection of mid-cap stocks.

It is important for investors that a dedicated Small & Mid Cap Fund is always able to sell small-capitalized stocks in the fund quickly without negative implications for the share price and thus on its own fund price. Various small-cap stocks have a much lower trading volume than blue chips. With the help of our Liquidity filter, we ensure that particularly illiquid stocks do not end up in our portfolio in the first place. The average trading volume over the last 30 days and the free float-adjusted market capitalization are decisive for the exclusion.

To ensure sustainable investment decisions, we use a multi-stage ESG filter process. In terms of sustainability, we aim to identify those companies that contribute particularly strongly to the achievement of the UN Sustainable Development Goals (SDGs). In a first step, we apply exclusion criteria relating to industries and products that counteract the sustainability goals. Examples include weapons production, nuclear power, coal, human rights violations, corruption, gambling, etc. In a second stage, based on a "Best in Universe" approach, we favor those companies that have an above-average ESG rating. Finally, we filter for "ESG Pure Plays", i.e. companies that produce 100% sustainable ecological products (ex: wind, solar, recycling, sustainable raw materials, innovative technologies, etc.). Please find detailed information about our ESG selection process in our ESG Information Guidelines.

Fundamental security analysis deals with the tasks already outlined in the section "Investment Concept".

Key review criteria in this context are:

• SWOT analysis of business model

• Earning its cost of capital

• Value-oriented manager renumeration

• Margin development

• Structural growth

• Identification of niches

• Structural shifts in industries and sectors

• M&A