Important Portfolio Element

Our investment concepts can be considered as crucial strategic building blocks. While the net equity ratio in our long/short fund is below 30% at any time we are predominantly fully invested in our "long only" equity fund. The two investment concepts thus have a completely different profile. The long/short fund is uncorrelated to equity and bond markets. On the other side the "long only" equity fund can be classified as an equity investment, but diversifies a blue chip equity portfolio.

The goal of asset allocation is to optimize the risk/return profile of an investment in a customer-oriented manner. It starts with a strategic asset allocation, i.e. proper long-term asset allocation to various investment classes. It is a way to reduce market risks such as stock market and interest rate risks through diversification.

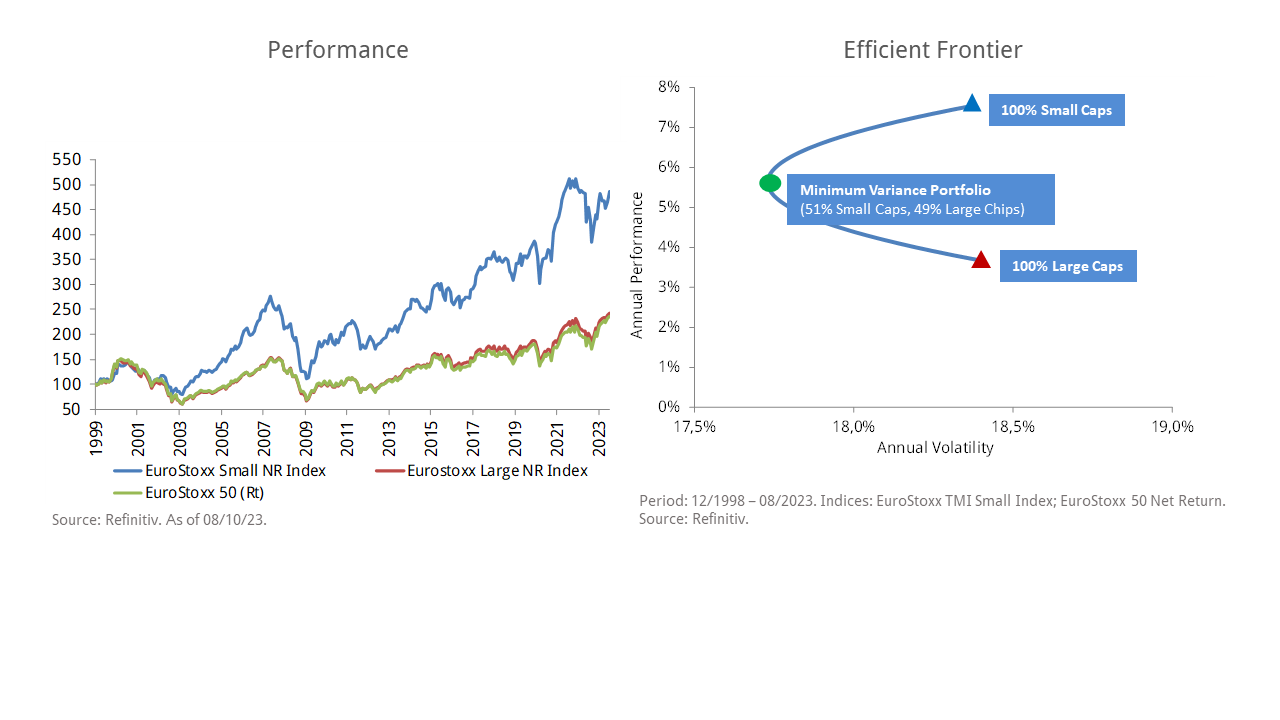

However, given the historically low interest rates, fixed income securities are unlikely to provide a positive return and a compensatory contribution to equity returns. Therefore, investing in alternative asset classes such as long/short is recommended regardless of the interest rate cycle. In addition, results (Markowitz optimization) show that Small & Mid Caps generate significantly higher returns than Blue Chips given the same volatility level. The optimal risk/return profile is indicated at a share of 50% of Small & Mid Caps in a stock portfolio.

Studies show that a long-term investment horizon and holding on to the initial strategic asset allocation leads to the superior results. Tactical asset allocation, i.e. changing investment quotas in the short-term leads to significant loss of wealth, especially in volatile markets. Since markets cannot be forecasted in the short-term, it is not recommended to change the portfolio structure on a frequent basis. We follow this advice also based on the individual stock level.